Behavioral Finance

The art and science of behavioral finance

Explore insights and tools to unlock the power of behavioral finance, strengthen client relationships and optimize investing outcomes.

Building a practice inspired by behavioral finance

Why is behavioral finance important?

Instincts and emotions sometimes drive the decisions clients make about money. With behavioral finance, we can help bridge the gap between what clients feel that they want and what you know they need financially.

The psychology of investing

To help clients feel confident in their investing plan, it’s important to understand how the psychology of investing works, how biases can influence investing outcomes and how behavioral finance can help you improve client relationships.

Biases: They’re Human Nature

It’s normal to have emotional or irrational reactions to market events, because that’s the human thing to do. But biased responses can work against investing outcomes. By knowing what sways people’s decisions, we can help them make better choices.

How to recognize and overcome behavioral biases when investing?

Review these common behavioral biases that might be influencing your investment decisions, and ask yourself if any resonate with you.

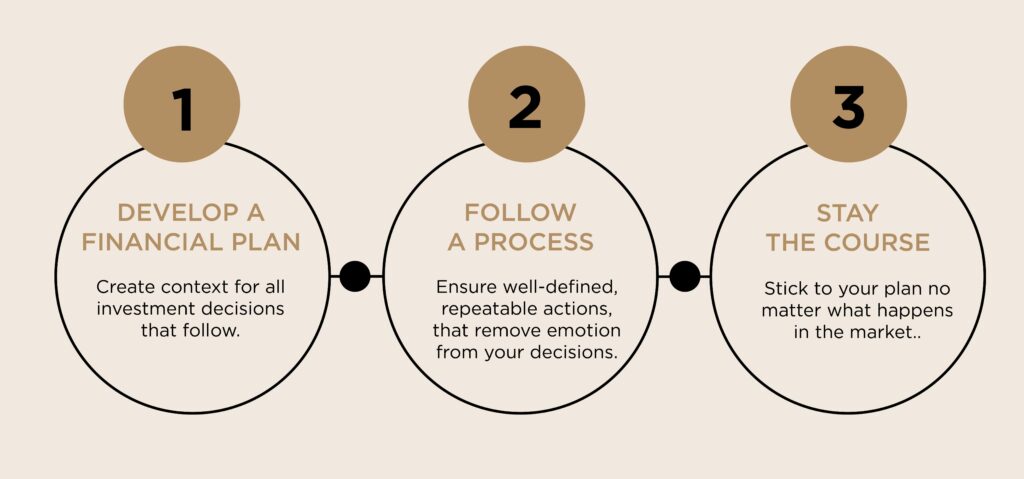

These biases all stem from human nature, which means nearly every investor in susceptible to them at some point. But there are steps you can take to mitigate the potential negative effects of bias on your own investment performance.

Source: Morningstar Direct, Mind the gap 2023

Portfolio Strategies

A well-designed portfolio is instrumental in positioning clients for long-term investment success. Key to this process is understanding the behavioral aspects of investing and how each individual is likely to respond through varying market cycles.

Applying behavioral finance to portfolios can help keep clients invested for the long haul. We aim to design investment portfolios that support strategic long-term, diversified, risk-appropriate investing across market conditions.